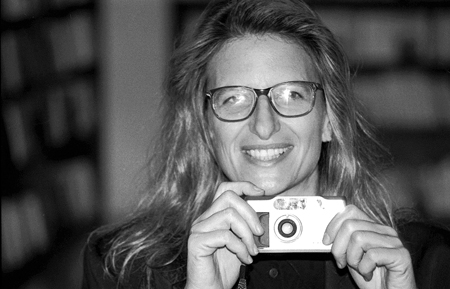

ABC News reports that Annie Leibovitz reached an agreement with her creditors that, at least for now, staves off the need for a bankruptcy filing.

What if Annie Leibovitz had filed for bankruptcy in New York?

Would she have to go through mandatory credit counseling (cost: $50) as required by the 2005 Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA)? Would she have to sit through a class with the huddled masses that tells her how she could have been a little more fiscally responsible with all of her multi-million dollar homes and valuable photograph collections?

The answer is yes, she would be subject to the mandatory credit counseling requirement. And it wouldn’t matter if she filed for Chapter 7, Chapter 11 or Chapter 13.

However, she would not have to sit in a class with the huddled masses, because the mandatory credit counseling requirement can be fulfilled by online courses as well as over the phone (unlike, say, traffic school).

Hopefully Ms. Leibovitz will not have to file for bankruptcy. But if she does, it’s good to know she has a few options. And if she’s reading this, she’s hopefully a bit relieved to hear that if she did need to take the mandatory credit counseling course, she could do it in the privacy of one of her many homes.

Though in the bigger picture, this hypothetical really just helps demonstrate the inanity of the mandatory credit counseling requirement under BAPCPA. Is a one-size-fits-all-debtors credit counseling course really the kind of help that someone like Annie Leibovitz needs right now? Probably not.

If you’re seeking bankruptcy lawyer Brooklyn NY, please feel free to contact me for a free initial consultation to discuss your situation. Whether you’re Annie Leibovitz or Auntie Em, I’ll help you figure out the best options and strategy available.

Go to www.nybankruptcy.net to learn more about Rosenberg Musso & Weiner LLP and/or to set up a free consultation.